CROP INSURANCE OVERVIEW

In 2022, more than 490 million acres of farmland were protected through the Federal Crop Insurance Program. Over 90% of insurable farmland in the U.S. is protected through the Federal Crop Insurance Program.

In 2022, the crop insurance program paid out over $14 billion in indemnities to farmers across the United States who purchased crop insurance. Crop insurance provides a safety net against perils such as frost, drought, flooding and hail. Without a strong crop insurance program, uncontrollable changes in weather could undermine the financial security of individual farmers and place the entire farm economy in jeopardy.

How Crop InsuranceWorks1

Two types of crop insurance are available to farmers in the United States: Crop-Hail and Multiple Peril Crop Insurance (MPCI).

Crop-Hail

Crop-Hail policies are not part of the Federal Crop Insurance Program and are provided directly to farmers by private insurers. Many farmers purchase Crop-Hail coverage because hail has the unique ability to totally destroy a significant part of a planted field while leaving the rest undamaged. In areas of the country where hail is a frequent event, farmers often purchase a Crop-Hail policy to protect high-yielding crops. Unlike MPCI, a Crop-Hail policy can be purchased at any time during the growing season.

Multiple Peril Crop Insurance (MPCI)

MPCI policies must be purchased prior to planting and cover loss of crop yields from all types of natural causes including drought, excessive moisture, freeze and disease. Newer coverage options combine yield protection and price protection to guard farmers against potential loss in revenue, whether due to low yields or changes in market price.

Under the Federal Crop Insurance Program’s unique public-private partnership, there are currently 15 private companies authorized by the United States Department of Agriculture Risk Management Agency (USDA RMA) to write MPCI policies. The service delivery side of the program — writing and reinsuring the policies, marketing, adjusting and processing claims, training and record-keeping, etc. — is handled by each private company. The program is overseen and regulated by the Risk Management Agency (RMA). The RMA sets the rates that can be charged and determines which crops can be insured in different parts of the country. The private companies are obligated to sell insurance to every eligible farmer who requests it and retains a large portion of the risk on over 80 percent of the policies written.

The federal government also subsidizes the farmer-paid premiums to reduce the cost to farmers. In addition, it provides reimbursement to the private insurance companies to offset operating and administrative costs that would otherwise be paid by farmers as part of their premium. Through this federal support, crop insurance remains affordable to a majority of America’s farmers and ranchers.

By combining the regulatory authority and financial support of the federal government with the efficiencies of the private sector, the crop insurance program has succeeded in meeting and even surpassing the goals set forth by Congress for broad participation, diversity and inclusion. By using the private sector, risk is shared among the private companies as well as the government.

1Source: Crop Insurance In America

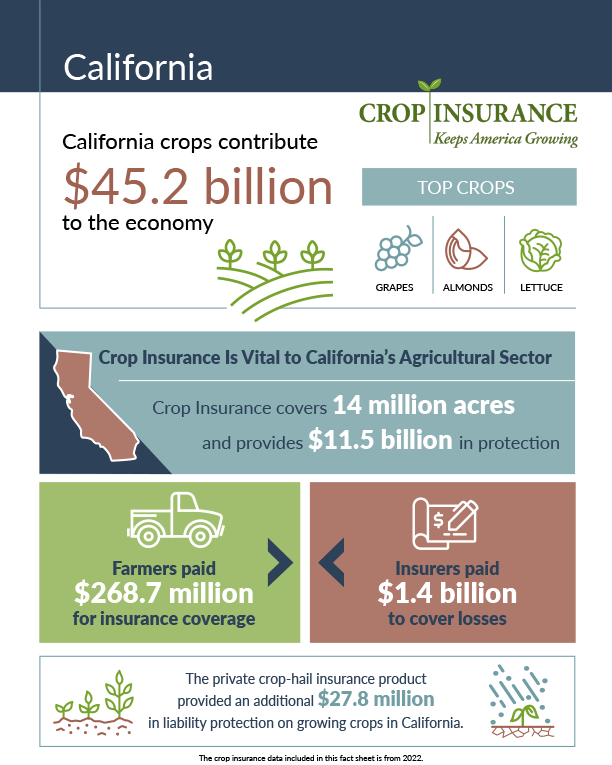

Agriculture is Vital to California

California crops contribute $45.2 billion to the economy. Click here to download the California Crop Insurance Data Fact Sheet.

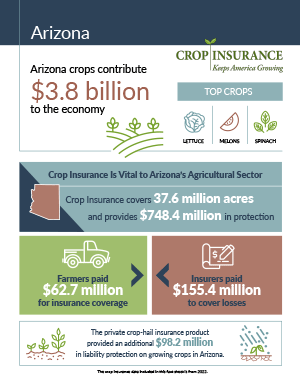

Agriculture is Vital to Arizona’s Economy

Arizona crops contribute $3.8 billion to the economy. Click here to download the Arizona Crop Insurance Data Fact Sheet.